Compound interest calculator

Simulate your investments and visualize the growth of your savings through the magic of compound interest.

Compound interest calculator

Results

Final balance

€

Total investments

€

Total accumulated interest

€

If you start with an initial investment of €1,000 and invest €100 per month at an annual interest rate of 5% for 10 years, you will reach a final capital of €16,722. This amount consists of €13,000 in deposits and €3,722 in interest or capital gains.

The results presented are simulations and do not constitute any form of financial advice.

Glossary

What is compound interest?

Compound interest is interest calculated on the initial amount and also on the accumulated interest from previous periods. This means that interest generates more interest over time, creating a "snowball effect" that can significantly increase your investment.

Example: 5% of €100 is €5. If we calculate 5% on €105 (€100 + €5), we get €5.25, where €5 comes from 5% of €100, while €0.25 comes from 5% of €5 (interest on interest).

Example: 5% of €100 is €5. If we calculate 5% on €105 (€100 + €5), we get €5.25, where €5 comes from 5% of €100, while €0.25 comes from 5% of €5 (interest on interest).

How does this tool work?

This calculator allows you to enter your initial investment, the monthly contribution you plan to make, the annual interest rate, the frequency of interest compounding, and the number of years of the investment. Based on this data, it calculates the total accumulated amount and presents you with an interactive graph and a detailed table of annual values.

Formulas used

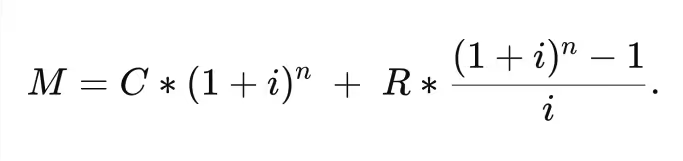

The calculator uses the following formula to calculate the accumulated amount:

- M: Final amount.

- C: Initial capital applied from the beginning of the first period.

- R: Periodic contribution (or "deposit"), made at the end of each period.

- i: Interest rate per period (can be monthly, quarterly, or yearly, depending on the case).

- n: Total number of periods considered in the simulation.

Note: The annual interest rate is converted to the period rate based on the compounding frequency. For example, an annual interest rate of 5% with quarterly compounding becomes an effective rate of ~5.10% (5% divided by 4 equals 1.25%; therefore, (1+1.25%)⁴ = 1.05094; if we subtract 1 and multiply by 100, we get 5.094%).

S&P 500 return calculator

If you’d like to reference a commonly used benchmark for U.S. stock market performance in our compound interest tool, consider the historical returns of the S&P 500.

From January, 1988 to December 31, 2024, the S&P 500 (including dividends) delivered an average annual return in euros of about 11.53%.

Although past performance doesn’t guarantee future results, some investors use this figure as a guide when entering the annual interest rate in our calculator.

Keep in mind that you cannot invest directly in an index, and factors like fees, taxes, and inflation can reduce your real returns.

From January, 1988 to December 31, 2024, the S&P 500 (including dividends) delivered an average annual return in euros of about 11.53%.

Although past performance doesn’t guarantee future results, some investors use this figure as a guide when entering the annual interest rate in our calculator.

Keep in mind that you cannot invest directly in an index, and factors like fees, taxes, and inflation can reduce your real returns.

Final note

Investing and taking advantage of compound interest is a smart strategy for the long-term growth of your wealth. The earlier you start investing, the more time you will have to benefit from the power of compound interest.

Remember, time is your best ally in the world of investments!

Remember, time is your best ally in the world of investments!