eToro review for European investors: safety, fees, pros & cons

eToro began in 2007 in Israel with a radical idea: combine social-media features with investing and trading.

Instead of a purely transactional broker, the platform lets users follow other people, see their trades in a news‑feed and even copy them.

For investors in the European Union, eToro can be appealing because it provides access to global equities and cryptocurrency markets and introduces the concept of social investing.

However, you should also be aware of the platform’s important limitations: the account base currency is U.S. dollars, conversion fees apply when depositing in euros, and many ETFs and indices are actually offered via CFDs - which are complex and risky financial instruments.

In May 2025 the company went public on Nasdaq under the ticker ETOR, strengthening its financial profile and subjecting it to additional regulatory disclosure.

eToro is a multi-asset investment platform. The value of your investments may go up or down. Your capital is at risk.

Highlights

Pros and Cons

Pros:

- Signup bonus for new users.

- User‑friendly platform with social features. eToro’s website and apps are designed for ease of use and integrate a social feed where you can see other investors’ comments and trades. Beginners can explore markets without immediately placing trades and can observe experienced investors’ strategies.

- CopyTrading and Smart Portfolios. The CopyTrader function lets you automatically copy the trades of other eToro members (the “Popular Investors”) in proportion to your chosen amount, starting from $200. Smart Portfolios provide themed baskets of assets and are curated by eToro’s investment team.

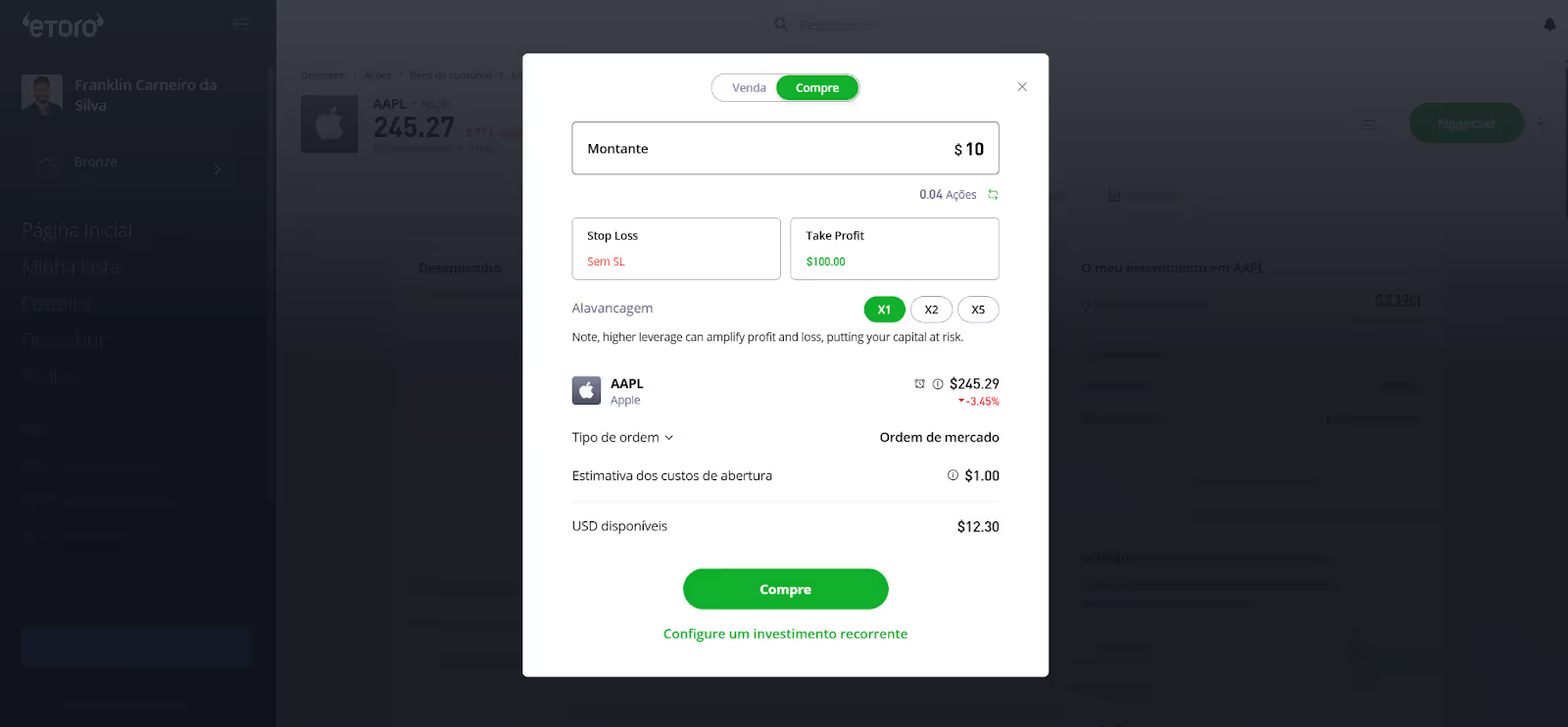

- Fractional shares. You can purchase very small fractions of a share, allowing you to invest in high‑priced U.S. companies with as little as $10.

- Low trading commissions. Stock trades on most U.S. exchanges are commission‑free; trades on some other exchanges cost $1 or $2. ETF trades via CFDs are also commission‑free, though spreads still apply.

- Demo account and educational resources. eToro offers a free demo account with $100 000 of virtual funds as well as an eToro Academy, which contains courses and guides for beginners, intermediate and advanced investors.

- Interest on idle USD balances. EU clients can receive up to 4.05% annual interest on uninvested U.S. dollars; this is competitive versus many traditional brokers, though interest is not paid on euro balances.

- Publicly traded company. eToro’s listing on Nasdaq and its solid financial position (no net debt and over $700 million in cash and equivalents) may provide comfort to risk‑averse investors.

Cons:

- USD-only accounts. eToro does not support accounts denominated in euros or other European currencies. When you deposit euros, they are converted into USD and a conversion fee is charged (from around 0.75% to 1.50% depending on method). The same happens on withdrawals: your USD balance is converted back to euros, again incurring fees. One way to avoid this is to use eToro's Money Wallet.

- High currency conversion costs. Even though eToro introduced the ability to deposit in several local currencies (SEK, NOK, DKK, CHF, HUF, PLN, CZK, RON), foreign‑exchange charges start at roughly 1%. For euro‑based investors, this makes eToro less cost‑effective than brokers that operate natively in euros.

- Complex and opaque use of CFDs. Many popular U.S. ETFs and indices cannot legally be sold to EU retail clients, so eToro offers them through CFDs that replicate the underlying asset. This is not always transparent: only at the trade‑confirmation stage is it made clear that you are buying a CFD, not the actual fund. CFDs are leveraged derivatives subject to overnight financing costs and a high risk of losing money.

- Limited product range. eToro does not offer direct access to bonds, options, futures or structured products. Access to some international stocks is also via CFDs. Transfers of stocks to other brokers are not permitted.

- Customer support limitations. Support is primarily through live chat. There is no telephone hotline for EU clients and no physical offices in most European countries.

- Non‑trading fees. The platform charges a $5 withdrawal fee and a $10 monthly inactivity fee after 12 months without login or trading.

Safety and regulation

Regulators

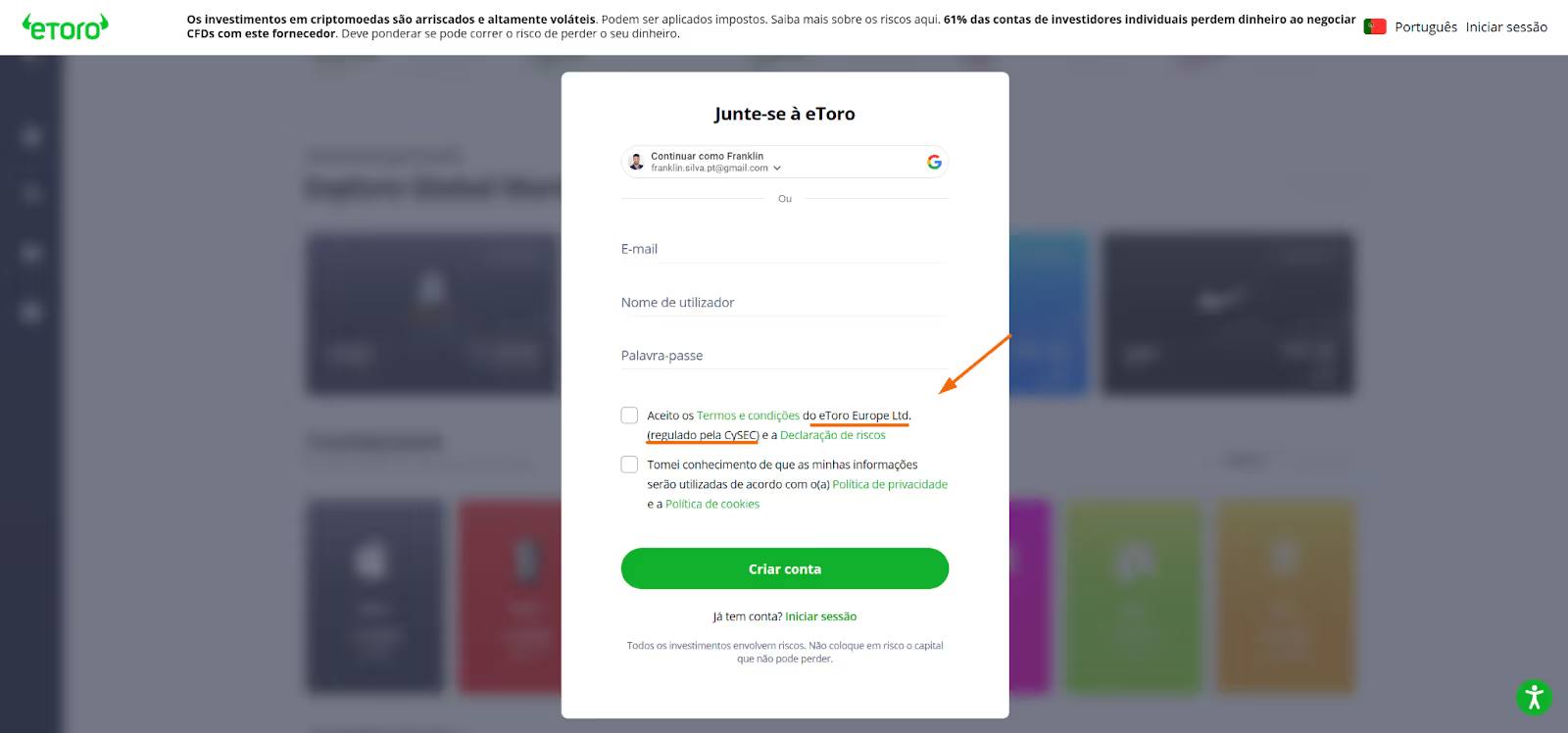

For investors in the European Union, your account is typically opened with eToro (Europe) Ltd, authorised and supervised by the Cyprus Securities and Exchange Commission (CySEC).

The platform also maintains licensing in other jurisdictions: eToro (UK) Ltd is regulated by the Financial Conduct Authority (FCA) in the UK, eToro AUS Capital Limited is regulated by the Australian Securities and Investments Commission (ASIC) and eToro USA Securities Inc. is registered with the U.S. Securities and Exchange Commission (SEC) and FINRA.

Investor Compensation

European retail clients of eToro (Europe) benefit from the Cyprus Investor Compensation Fund (ICF), which covers up to €20 000 per client.

The compensation equals the lower of 90% of the investor’s covered claim or €20 000 (e.g., a claim of €10 000 is compensated up to €9 000, and a claim of €50 000 is compensated up to €20 000).

Additional Insurance

For Platinum, Platinum+ and Diamond members of the eToro Club, the broker provides an additional private insurance policy underwritten by Lloyd’s of London. This policy covers up to €1 000 000 per client in the event of eToro’s insolvency or mismanagement. Coverage applies only to losses beyond the €20 000 provided by the ICF and has an aggregate cap of €25 million across all claimants.

Financial Position

Following its Nasdaq listing in May 2025, eToro reported that it holds no net debt and maintains more than $700 million in cash and equivalents. This strong balance sheet provides an additional layer of comfort to investors.

Summary of safety

Interest on uninvested funds

One of eToro’s attractive features is that uninvested cash held in USD can earn interest.

As of 2026, EU clients can earn up to 3.55% per year on idle USD balances. The rate varies depending on the amount you hold and your Club tier.

Importantly, no interest is paid on euro balances.

For European investors, holding large cash balances in USD subjects you to currency‑risk, as movements in the USD/EUR rate can affect your euro‑denominated wealth.

You can check our article covering the best savings accounts in Euros.

Customer support

Customer support is primarily provided through live chat, available in several languages.

Higher‑tier Club members (Silver and above) receive WhatsApp support and can request dedicated account managers.

However, no telephone support is offered to EU clients and eToro does not maintain physical offices in most other EU countries.

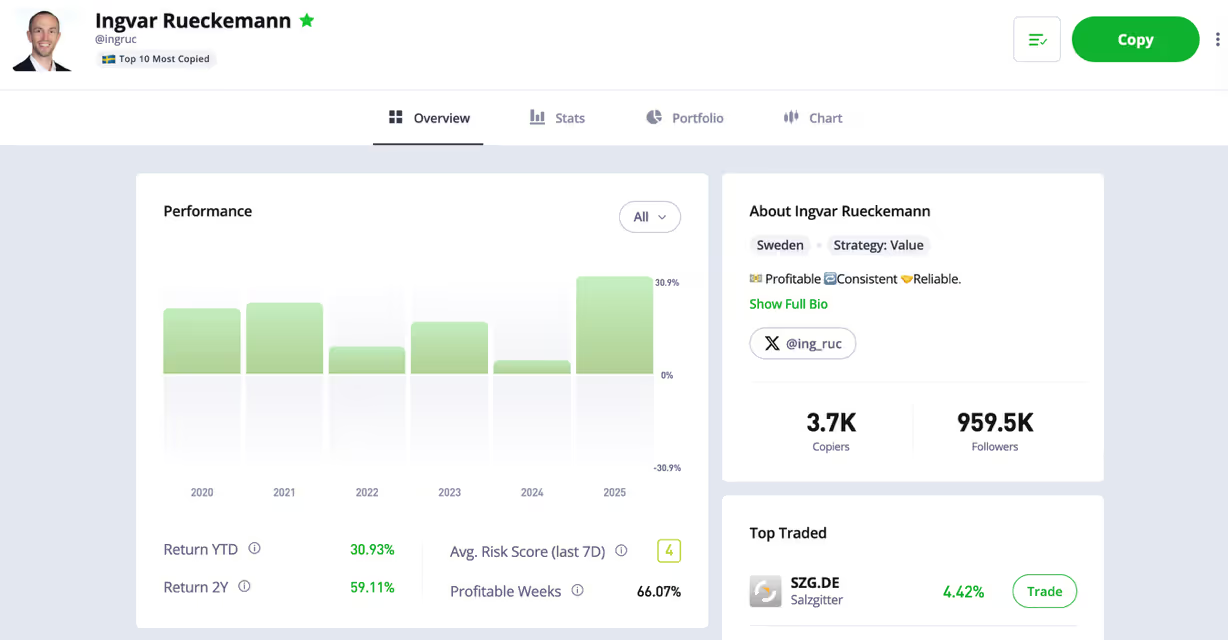

CopyTrading: eToro’s Signature Feature

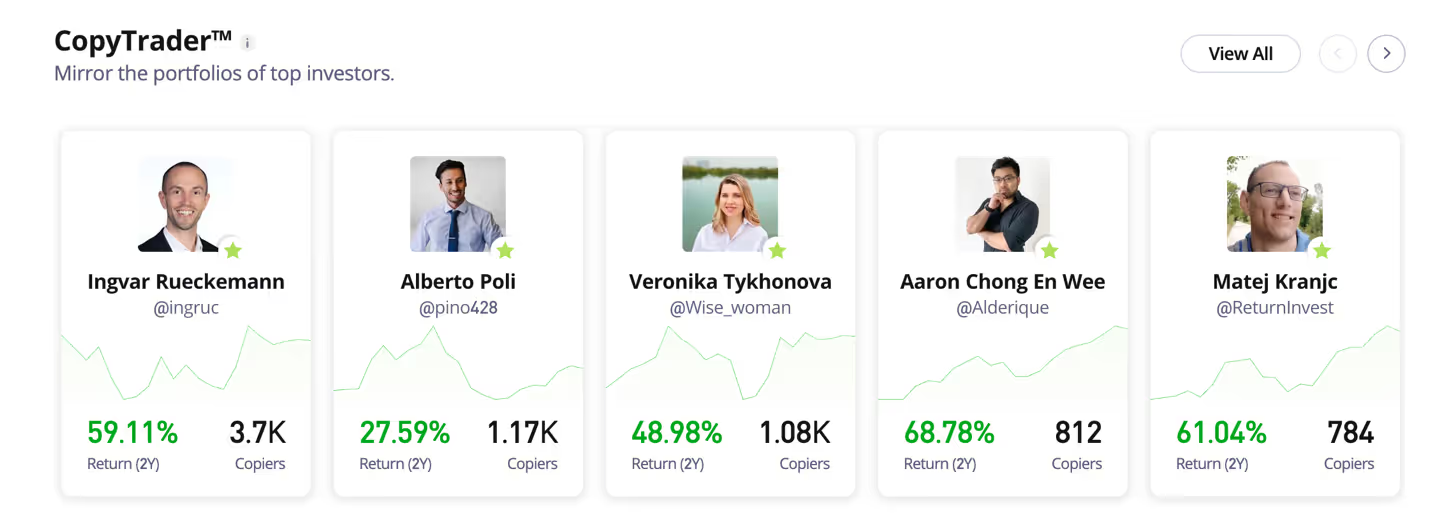

eToro’s CopyTrader function sets it apart from many other brokers.

It allows you to allocate a portion of your capital (minimum $200) to automatically mirror the trades of another eToro member designated as a “Popular Investor.”

You can browse Popular Investors’ profiles, which include historical returns, risk scores, asset classes and other statistics.

Once you decide to follow someone, all of their trades will be replicated in your account in proportion to the allocated amount.

This tool can be useful if you find a trader whose strategy aligns with your goals and you lack the time or expertise to select individual securities.

To use CopyTrader effectively, examine metrics such as the investor’s long‑term performance, risk score, percentage of profitable trades and the average holding period. Avoid focusing solely on sensational short‑term returns; consider whether the trader employs a sustainable, diversified strategy.

Copy Trading does not amount to investment advice. Your investments value may go up or down. Your capital is at risk.

Risks of Copy Trading

While CopyTrading may appear to be a hands‑off route to investing success, it carries significant risks.

- Survivorship bias. You see only the investors who are currently performing well; those who underperform often stop sharing their results or drop out of the programme. This can create the illusion that “everyone” is consistently profitable when that is rarely the case.

- Over‑trading and costs. When you copy an active trader you may end up making many small trades. Each trade incurs spreads and currency‑conversion costs, which can erode returns even if the trader’s gross performance is positive.

- Lack of control. You cannot influence the investor’s asset choices. If they suddenly decide to invest in high‑risk cryptocurrencies or use leverage, your funds will follow suit.

Fees

eToro’s most significant costs are summarised below:

Check the full list of fees here.

Currency conversion explained

Because eToro denominates all accounts in U.S. dollars, euro‑zone investors cannot keep funds in euros on the platform.

When you deposit euros, the broker automatically converts them to USD and charges a conversion fee. For example, depositing €1 000 could result in around €992.50 available for investment after a 0.75% fee.

The same applies in reverse when withdrawing - your USD balance is converted back to euros, incurring another fee.

This currency friction makes eToro comparatively less attractive for investors whose home currency is the euro.

Competitors like DEGIRO, Trade Republic and XTB operate with euro‑denominated accounts and allow you to trade euro‑quoted stocks and ETFs without conversion.

eToro recently introduced deposits in certain Scandinavian and Eastern European currencies, but the base account remains USD and FX fees start at roughly 1%.

eToro Academy

eToro provides an Academy for investors who want to learn trading fundamentals.

The Academy offers structured courses and guides divided into beginner, intermediate and advanced levels and covers topics such as technical analysis, risk management and diversification.

How to use eToro

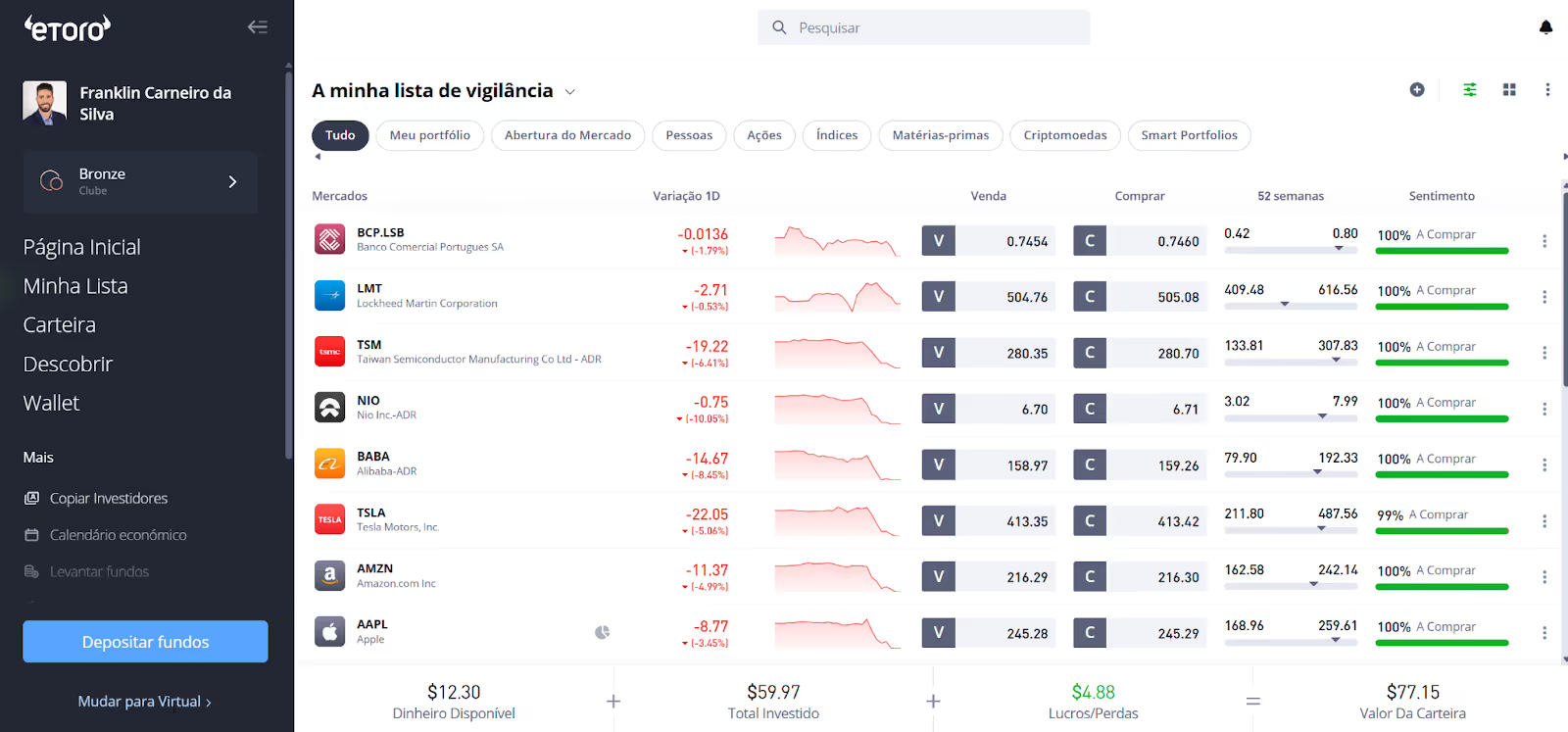

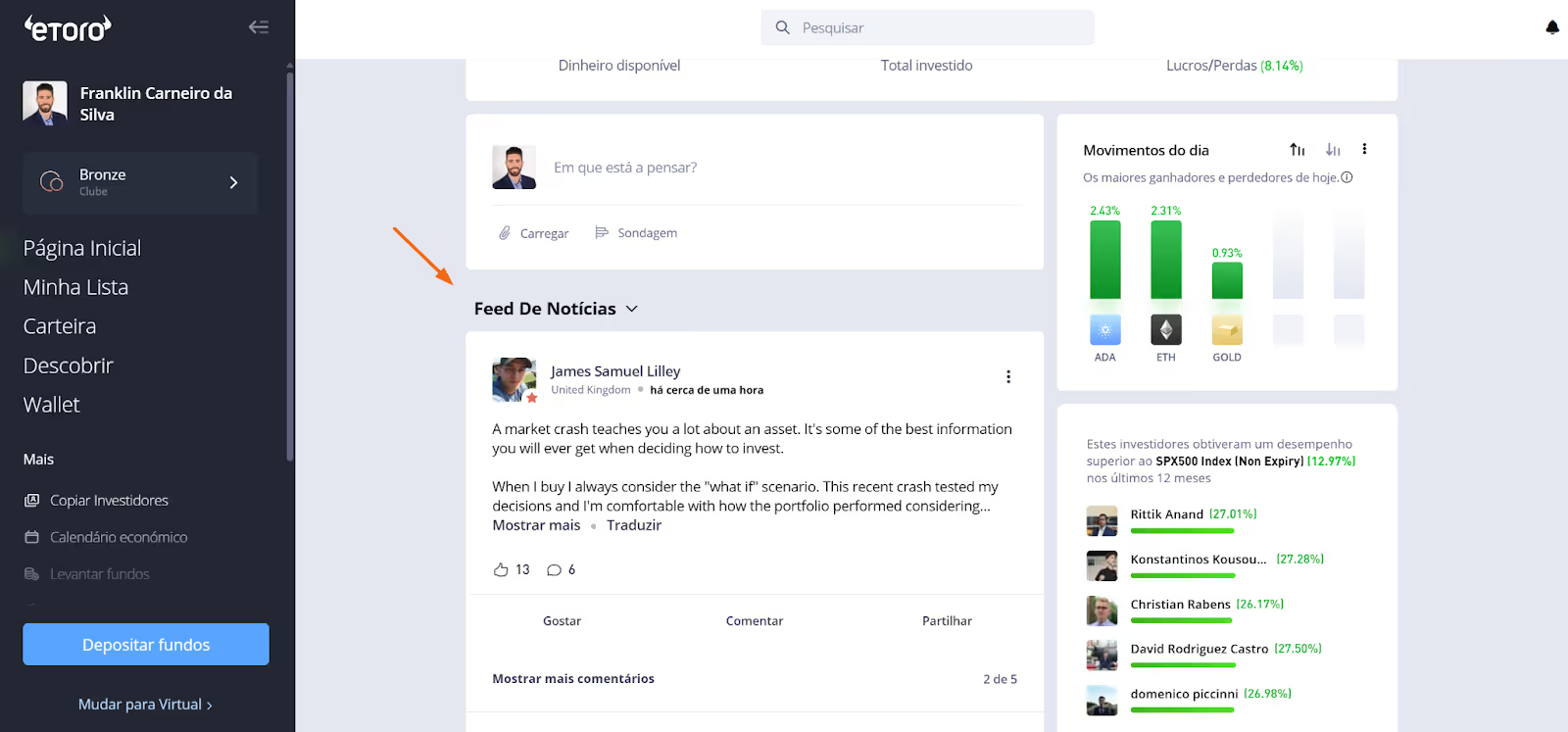

After you log in, the dashboard displays your portfolio, watchlist, news feed, markets and quick access to Popular Investors for copy trading.

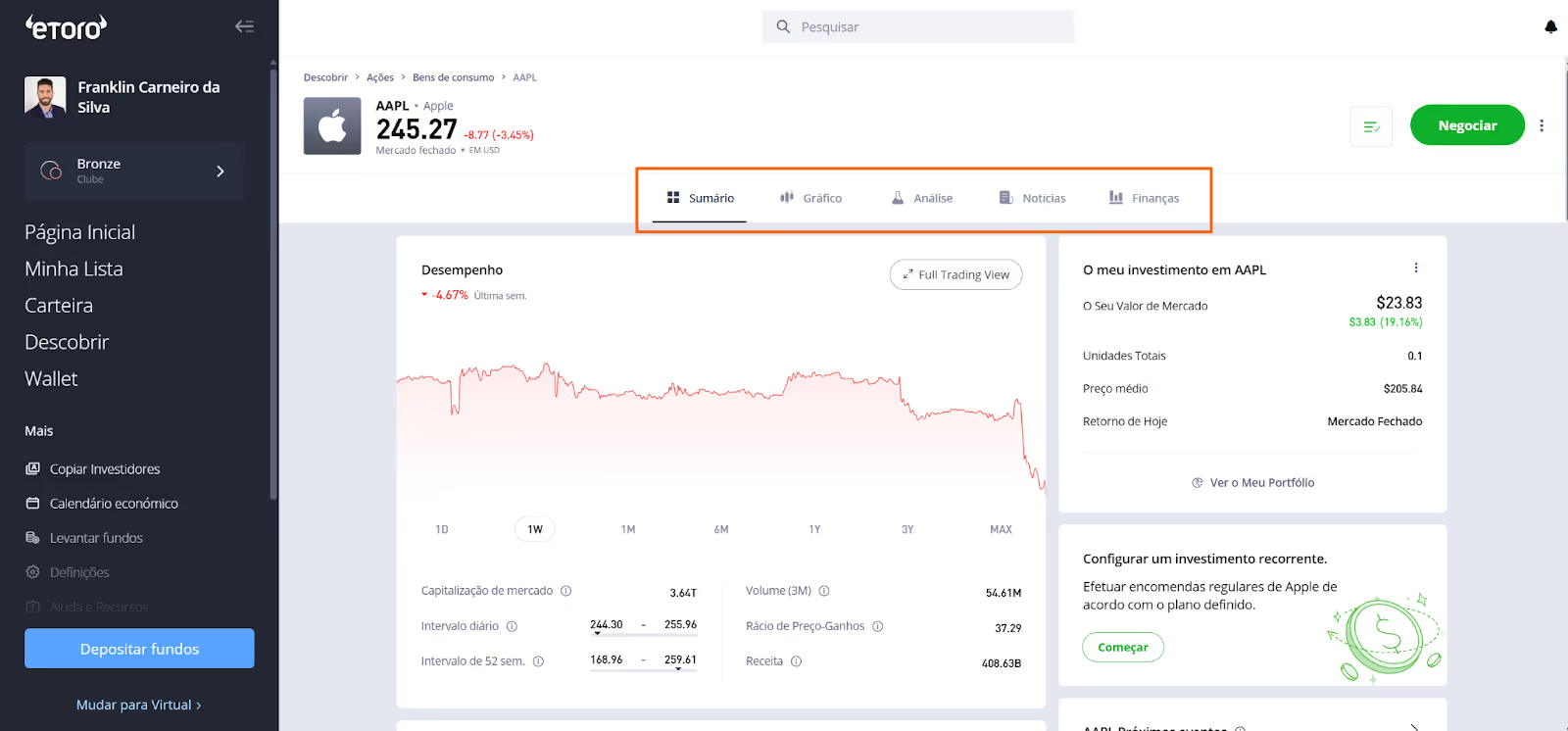

The interface is intuitive: under Portfolio you can monitor each investment’s performance

Watchlist allows you to track assets you’re interested in.

The News Feed functions like a social network where investors post and discuss ideas.

When viewing a particular asset, you’ll see statistics such as historical price data, technical indicators and fundamental information.

To place an order, click on the asset, select “Trade”, then enter the amount you wish to invest and choose your order type (market, limit, etc.).

If you’re copying an investor, you select the amount to allocate (minimum $200) and eToro will automatically mirror that person’s trades in your account.

Asset classes on eToro

Shares

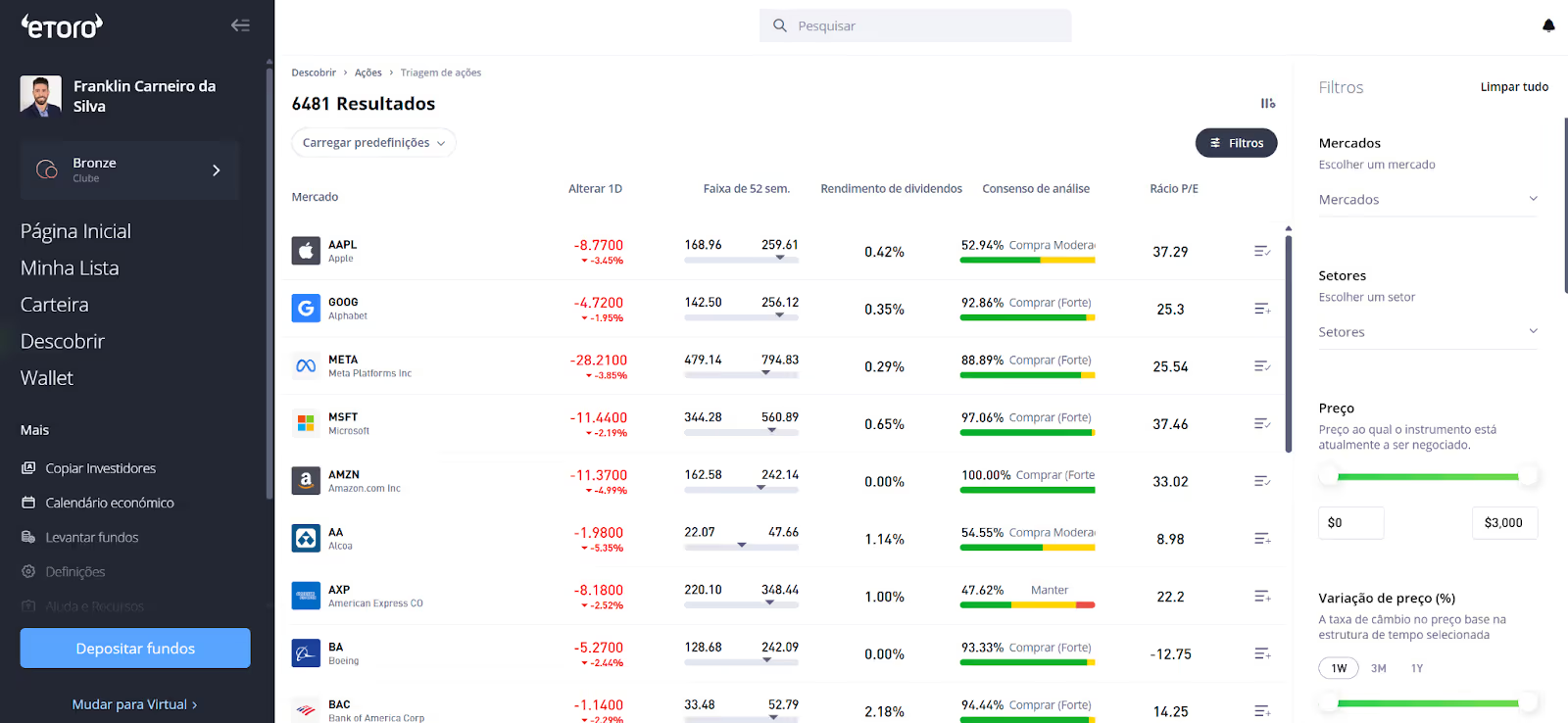

eToro offers access to more than 6 000 shares listed on major exchanges across the United States, United Kingdom, Germany, France, Spain, Italy and other countries. You can buy fractional shares and trade U.S. stocks.

ETFs

You can search and filter ETFs by asset class, sector, dividend yield and other criteria.

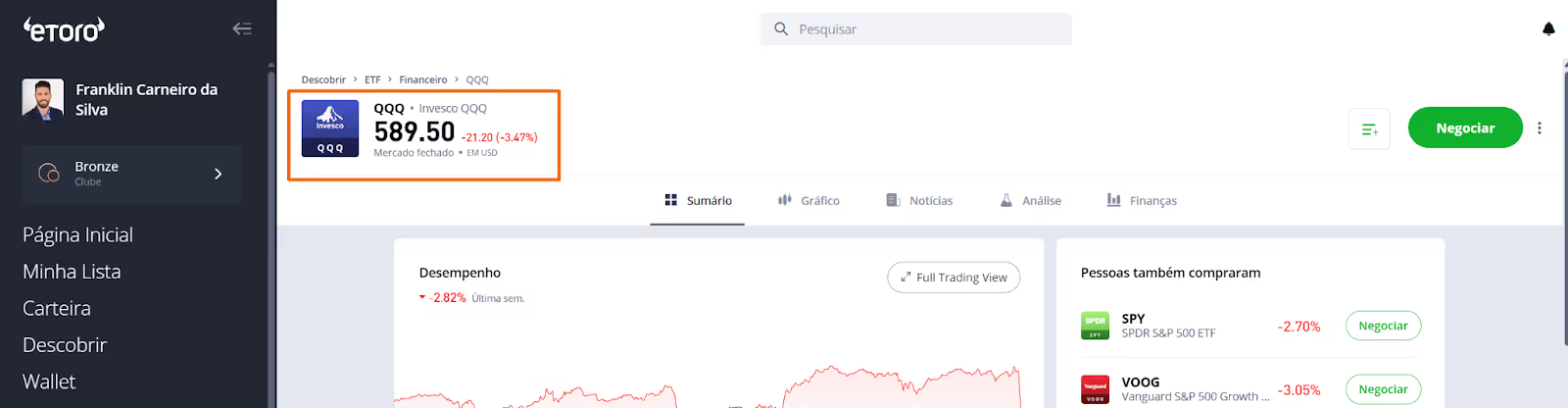

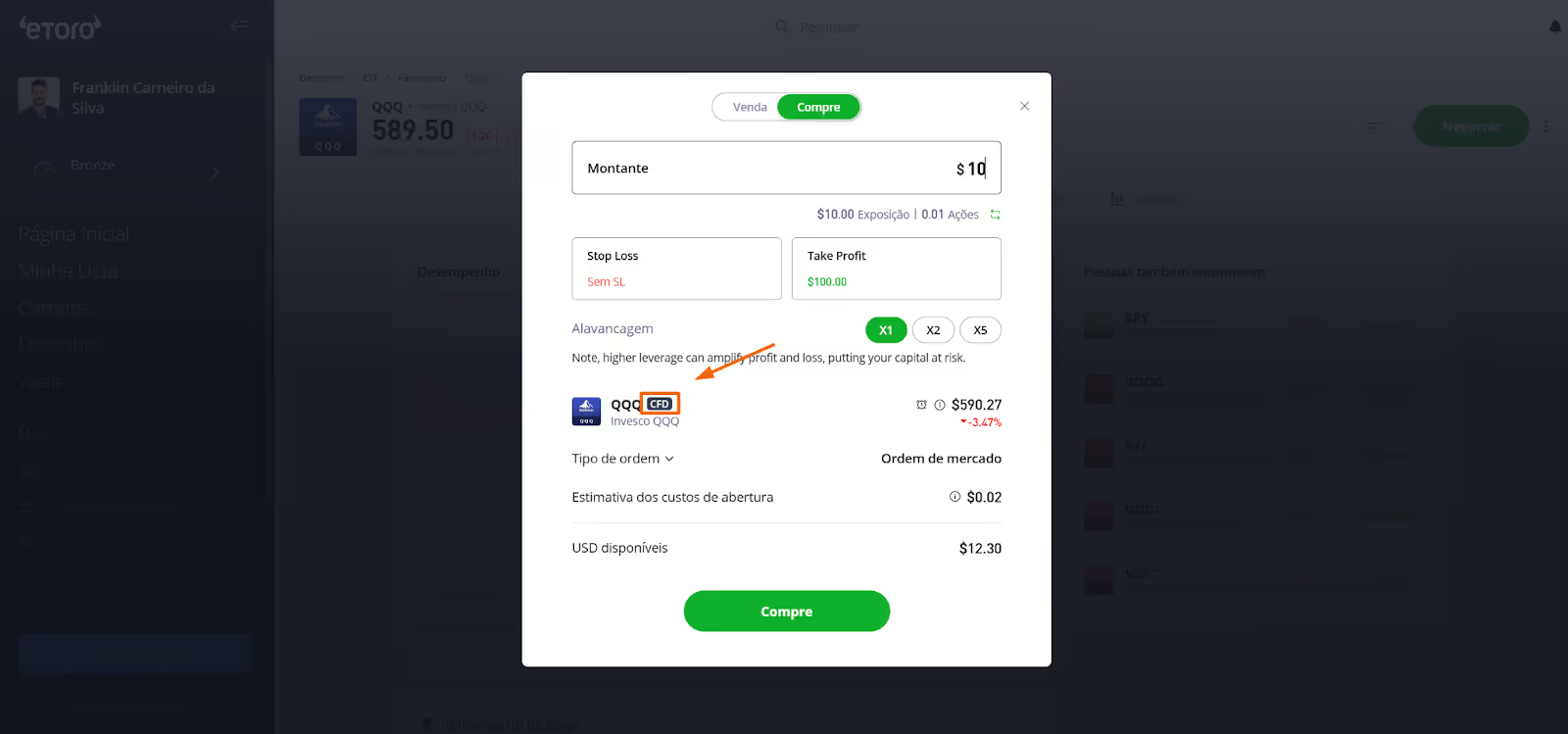

Due to European regulations, most U.S.‑domiciled ETFs cannot be sold directly to EU retail investors. eToro therefore provides exposure via CFDs that emulate the fund’s performance. This means you do not own the actual ETF units; instead, you hold a leveraged derivative that mirrors price movements and pays synthetic dividends. The CFD status is disclosed only in the final trade window, which may be confusing.

Here is the example of QQQ, a US ETF:

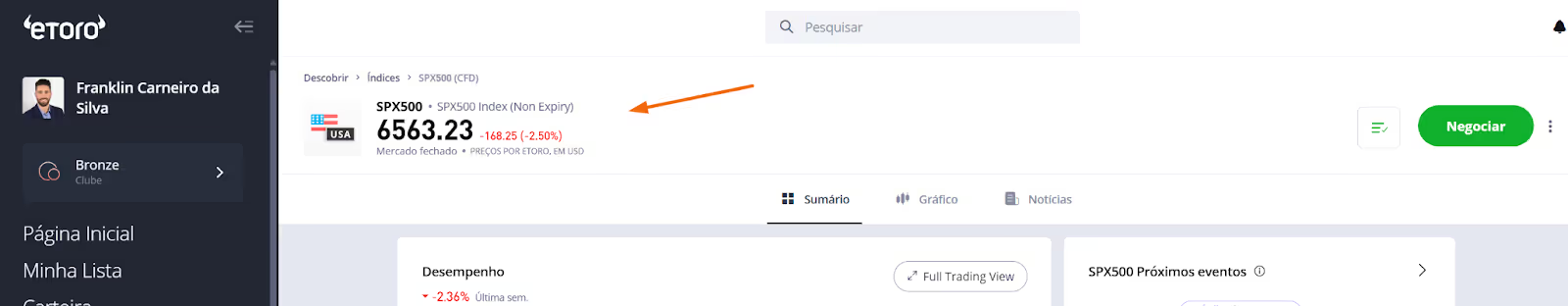

The same applies to many stock market indices such as the S&P 500 - you are trading a CFD, not the index itself:

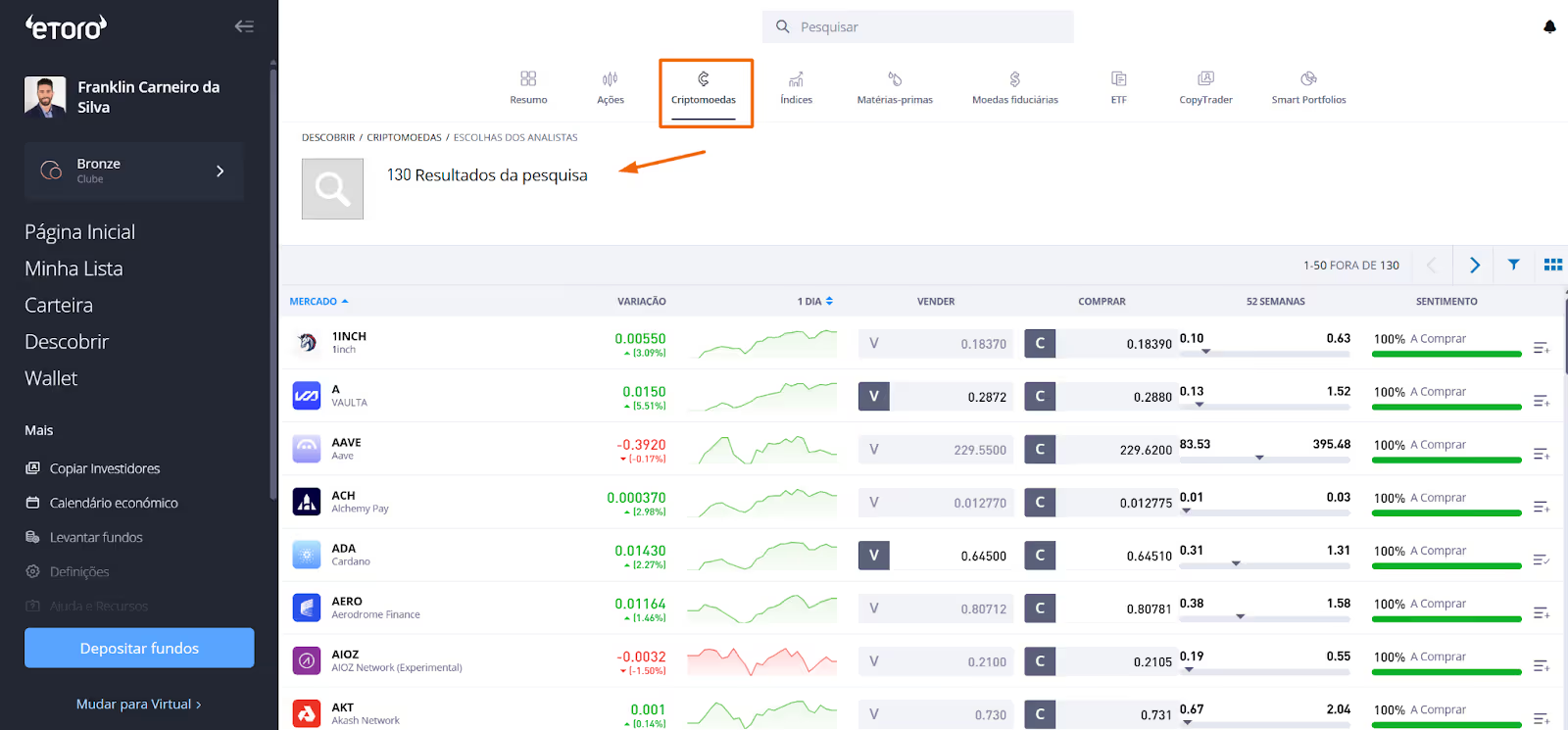

Cryptocurrencies

The platform offers over 130 cryptocurrencies. Trades incur a 1% fee each way. Regulation of crypto assets is evolving, and you should note that crypto trading is not supervised by EU investor‑protection frameworks.

Crypto investments are risky and highly volatile. Tax may apply. Understand the risks here https://etoro.tw/3PI44nZ.

Forex

eToro allows trading of 62 currency pairs through CFDs. As with ETFs, these are derivatives: you are not buying the actual currency, but speculating on relative movements. Leverage is available, but EU rules limit leverage for retail traders to protect against large losses. Spreads can be wider than those at specialist forex brokers, and overnight financing costs apply.

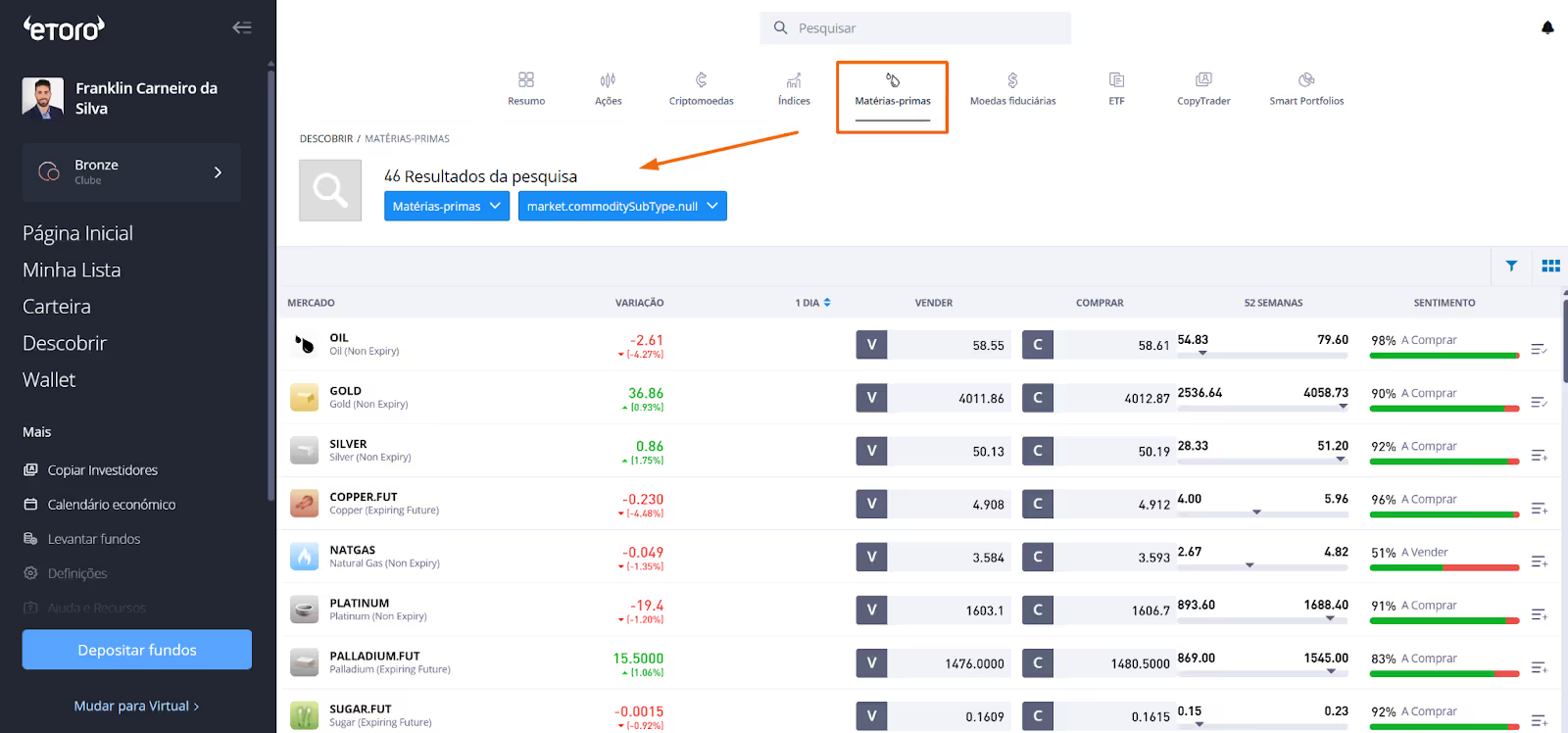

Commodities

You can also trade more than 45 commodities via CFDs.

These instruments give you price exposure to gold, oil, silver and agricultural products, but again you do not own the physical commodity. CFDs involve counterparty risk, leverage and daily financing charges. Many investors lose money trading CFDs, so these products are suitable mainly for experienced traders.

The table below summarises the instruments available on eToro:

Conclusion

eToro remains one of the most innovative brokers on the market, combining social‑media‑style features with a comprehensive range of tradable instruments.

For European investors, it offers easy access to U.S. equities, cryptocurrencies and social trading.

Yet its business model relies heavily on implicit fees: the USD base currency and associated conversion costs are a significant source of revenue; many assets are offered via complex CFDs rather than straightforward securities; and spreads and overnight charges can eat into returns. Other brokers operating natively in euros may offer lower total costs for buy‑and‑hold strategies.

In summary, while eToro might appear cheap at first glance, hidden costs like currency‑conversion fees (from ~0.75%) and CFD spreads can erode investment performance.

Weigh these factors carefully before choosing eToro as your broker.

Interested in learning more about eToro? Explore their website and decide for yourself!

Disclaimer: This article does not provide financial advice or investment recommendations. It is for informational and educational purposes only. Always conduct your own research or consult a licensed professional before making investment decisions. eToro is a multi-asset investment platform. The value of your investments may go up or down. Your capital is at risk. CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 46% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.