Revolut sign up bonus: welcome promo up to €30

Revolut is one of the most popular digital banking apps in Europe, and today we’re sharing exclusive welcome bonuses available to our EU Personal Finance readers.

If you’re considering opening a Revolut account, you can claim €10-€30 in rewards (or local equivalents) by signing up through the bonus links below.

We also explain how the Revolut referral bonus works and what makes Revolut one of the most versatile digital accounts in Europe.

If you’re comparing online banks or still deciding, you may also like our guides:

Current Revolut promo offers by country

Revolut promotions change depending on your country of residence. Here are some of the most common examples available across Europe (offers subject to Revolut’s Terms & Conditions):

🇳🇿 New Zealand – Get NZ$15

🇬🇧 UK – £20 welcome bonus

🇮🇪 Ireland – €10 welcome bonus

🇸🇪 Sweden – 300 kr welcome bonus

🇫🇮 Finland – €30 bonus

🇩🇰 Denmark – kr. 200 welcome bonus

🇳🇴 Norway – Spend 250 NOK → get 250 NOK

🇦🇺 Australia – Get $30 bonus

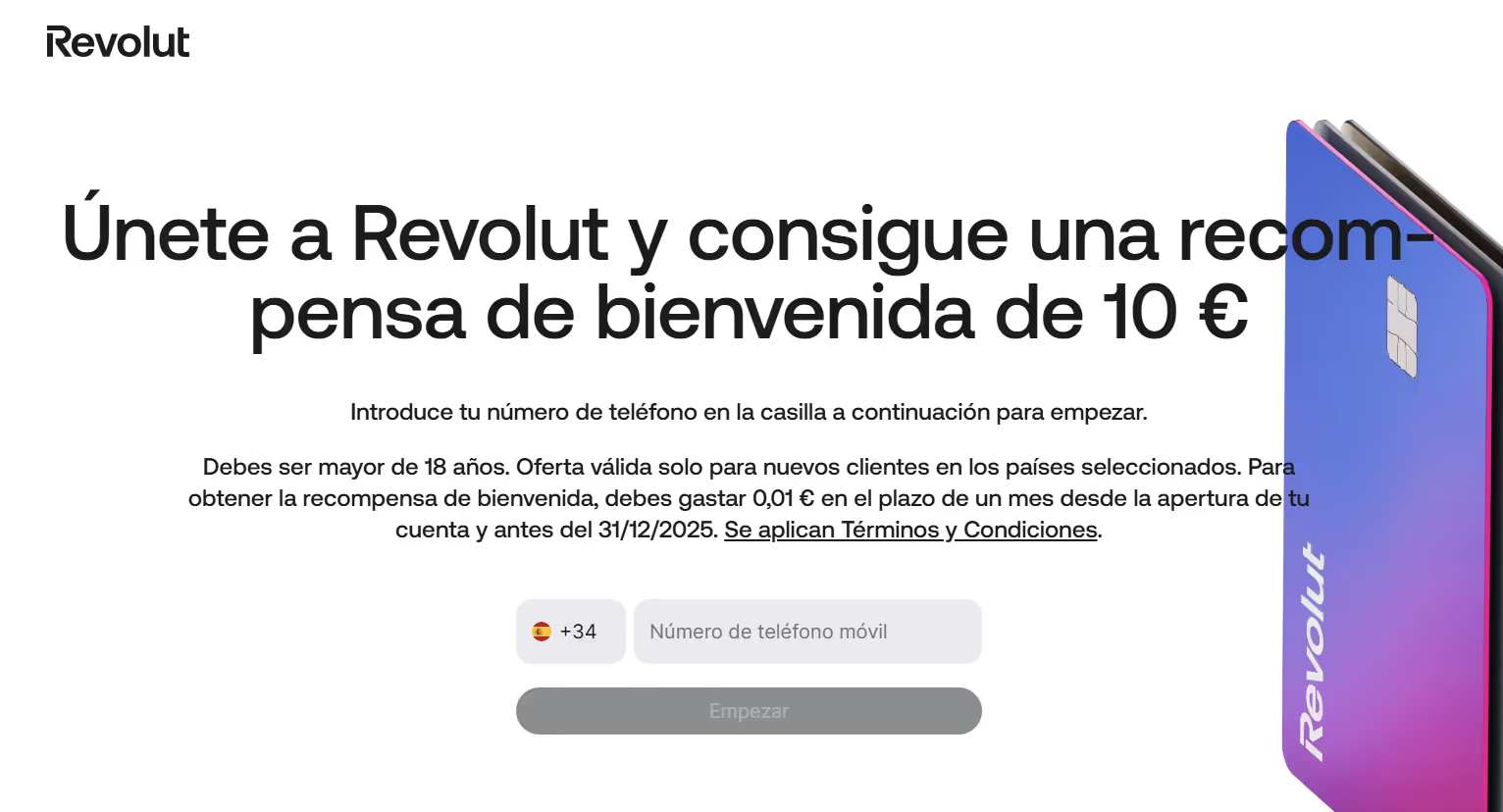

🇪🇸 Spain – €10 welcome bonus

🇫🇷 France – €20 welcome bonus

🇨🇭 Switzerland – Fr 20 bonus (Spend 20 CHF Get 20 CHF)

🇺🇸 USA – $10 reward

🇵🇹 Portugal – Spend €10 → get €10

🇮🇹 Italy – Spend €20 → get €20

🇵🇱 Poland – Spend 150 PLN → get 150 PLN

🇧🇪 Belgium – Spend €0.01 → get €20

🇩🇪 Germany – Spend €0.01 → get €20

🇳🇱 Netherlands – Spend €0.01 → get €20

🇳🇴 Norway (alt offer) – Spend 0.01 kr → get 235 kr

How the bonuses work

Spain – €10 Welcome Bonus

Join Revolut and get a €10 welcome reward.

You must be over 18 years old and a new customer. To unlock the reward, spend at least €0.01 within one month of opening the account and before 31/12/2026.

Portugal – €10 Welcome Bonus (how it works)

Open a Revolut account and receive a €10 sign-up bonus.

Must be over 18 and a new customer. To redeem the bonus, spend €10 within one month after registration and before 31/12/2026.

Italy – €20 Welcome Bonus

Open your account and get a €20 Revolut bonus.

Complete the registration, top up your account, and spend €20 within one month. Offer valid for new customers living in Italy.

These offers are examples of ongoing Revolut promo campaigns. Revolut may offer different welcome rewards across the EU, so the exact bonus may vary by country.

How to claim your Revolut bonus (typical steps)

- Use a valid Revolut promo link or Revolut promo code: The registration must begin through the promotional link for the bonus to apply.

- Download the Revolut app and complete sign-up: This includes verifying your identity (KYC). The process usually takes just a few minutes.

- Make the minimum required purchase: Depending on your country, this could be €0.01, €10, €20 or another amount.

- Receive your welcome bonus: After completing the requirements, Revolut typically credits the bonus within a few working days.

Important conditions (vary by country)

- Offer valid only for new Revolut customers.

- You must complete all required tasks within 30 days.

- Only applicable when registering through the official promotion flow.

Revolut referral bonus: How “Invite Friends” works

In addition to the welcome reward, Revolut also offers ongoing referral campaigns that reward existing users who invite friends. These bonuses are independent of the sign-up promotions.

The Revolut referral bonus usually requires the invited friend to:

- Sign up through the referral link

- Verify identity

- Add money to their account

- Order a physical card or complete a few transactions

Rewards vary significantly, from €10 to €60 per friend, and change frequently. The app always displays the latest active campaign. If you’re already a Revolut user, check the “Invite Friends” section for current conditions.

Why Europeans choose Revolut

Revolut’s popularity is driven by its modern tools and transparent pricing.

1. Savings vaults with interest

Revolut offers interest-earning savings accounts with instant access. Rates vary by country and plan, but higher tiers (Premium, Metal, Ultra) offer higher annual interest.

2. Physical and virtual cards

- Disposable virtual cards for secure online shopping

- Google Pay and Apple Pay compatibility

- Full card controls inside the app

3. Free instant transfers between users

Perfect for splitting bills or sending money within seconds.

4. International payments

Send and spend in 29+ currencies with competitive exchange rates.

5. Money transfers abroad

Ideal for users with family or business abroad, often cheaper than traditional banks.

Regulation, deposit protection & security

Revolut Bank UAB is licensed in Lithuania and passported across the EU.

Your money is protected:

- Deposits up to €100,000 protected by the Lithuanian Deposit Guarantee Scheme

- Investments protected up to €22,000 through the Investor Compensation Scheme

- Client assets are held separately from Revolut’s corporate funds

Conclusion

The Revolut sign-up bonus is one of the easiest ways to start using Europe’s most popular digital banking app with extra money in your account.

At EU Personal Finance, we only share offers that we personally support.

Combined with features like multi-currency accounts, savings tools, local IBANs, deposit protection, and fast international transfers, Revolut stands out as one of the most complete digital banking solutions in Europe.

Want to compare Revolut with other options?

Check out our guides on: